Location start-ups raised $3.7 B in Q3, according to CB Insights

The coronavirus triggered some argument amongst Boston’s equity capital neighborhood. Recalling at our mid-2020 survey of its VCs, some saw the city’s strength in biotech and healthcare as a competitive advantage, while others saw Boston’s varied start-up ecosystem as key to its survival.

And some were stressed that activity was about to secure down. Jeff Bussgang, Flybridge Capital, put it most frankly: “Q2 funding for Boston is going to fall off a cliff.

With fresh information in hand, it appears that the more bullish were more right than the bears and that, in a good turn of affairs for Boston startups, Bussgang was incorrect.

The city, much like the country, did not see the greatly unfavorable quarter that lots of expected. Boston published record equity capital financial investment in the duration, its highest total since a minimum of Q3 2018 according to CB Insights data.

The exact same dataset also says that Boston-area companies raised $3.7 billion across 126 deals. The excellent news from Boston’s Q1 bested better-than-anticipated-results from both the worldwide endeavor capital community, and the domestic VC world in Q2.

Bussgang sent an updated metaphor to the TechCrunch team in response to this data: “It was a tundra in March and April but, as occurs in Boston, April showers and May flowers began and the funding markets started to gush again in the late spring/early summer season, just in time to conserve Q2.”

While the information isn’t historically conclusive due to reporting lags, it can be utilized as a directional sign that Boston’s rebound isn’t ahead of us, it’s upon us.

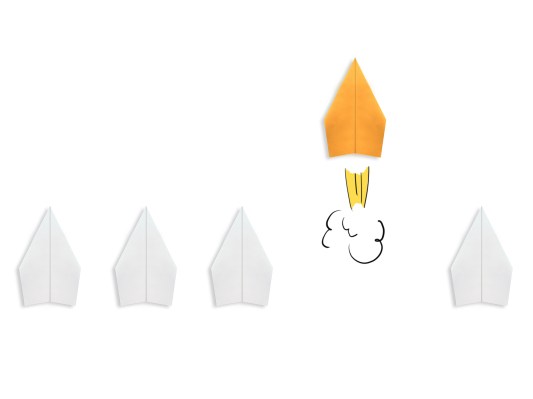

The strong numbers are an indication that COVID-19 and financial turmoil have put lots of start-ups in higher need than in the past, which means that they require to generate money to satisfy development needs.

TechCrunch.